Amended Returns Ready for E-file

After many years of IRS rumors, the ability to e-file an Amended U.S. Individual Tax Return (1040-X) is finally here! On August 17th the Wintax 1040 software will update to include this new capability with some IRS stipulated limitations of course. Please read the list below.

1040-X E-File Limitations:

- Amended returns will only be accepted for the current year (tax year 2019). Prior years must continue to be filed by paper.

- If the amended return results in a refund, the refund will be issued by paper check, not through direct deposit.

- Only a 1040 or 1040-SR that was originally electronically filed can have the amended return sent via e-file.

- The IRS will receive both the Form 1040-X and the complete Corrected 1040 return.

- Signatures for the corrected Form 1040 and the Form 1040-X are both required when filing an electronic amended return.

- The 1040-X e-file will be taken offline on the same dates as the rest of the 1040 program in November, etc.

- The filing status on the amended return must match the filing status on the original return.

- The primary and secondary TIN on the amended return must match the primary and secondary TIN on the original return.

- A dependent claimed on someone else’s return cannot be claimed on the E-filed amended return. It must be filed by paper.

Wintax Instructions:

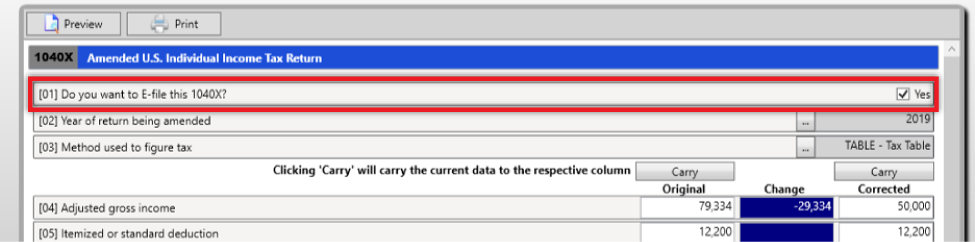

Mark the new check box on the 1040X screen to indicate that you want to e-file the amended return.

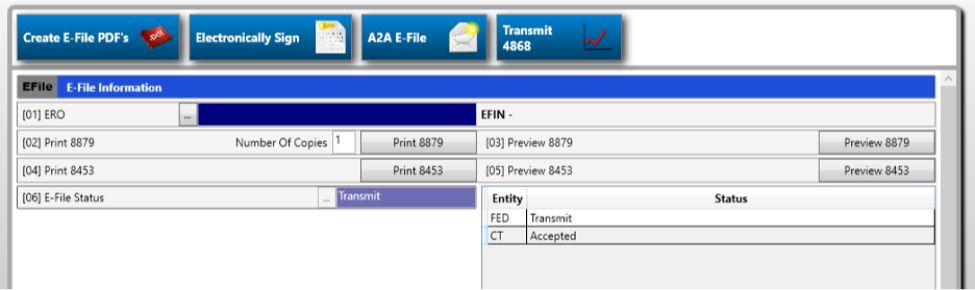

When the 1040-X is ready to send. Go to the E-File Information Screen:

- Change the Federal E-file Status to “Transmit”

- Transmit the return to the IRS.

Yipeeeeeee!

I’m so excited !!!! Made my day .

Thank you very much

Can you file an amended return for an injured spouse ?