Advance Child Tax Credits Due Diligence

Did you know?

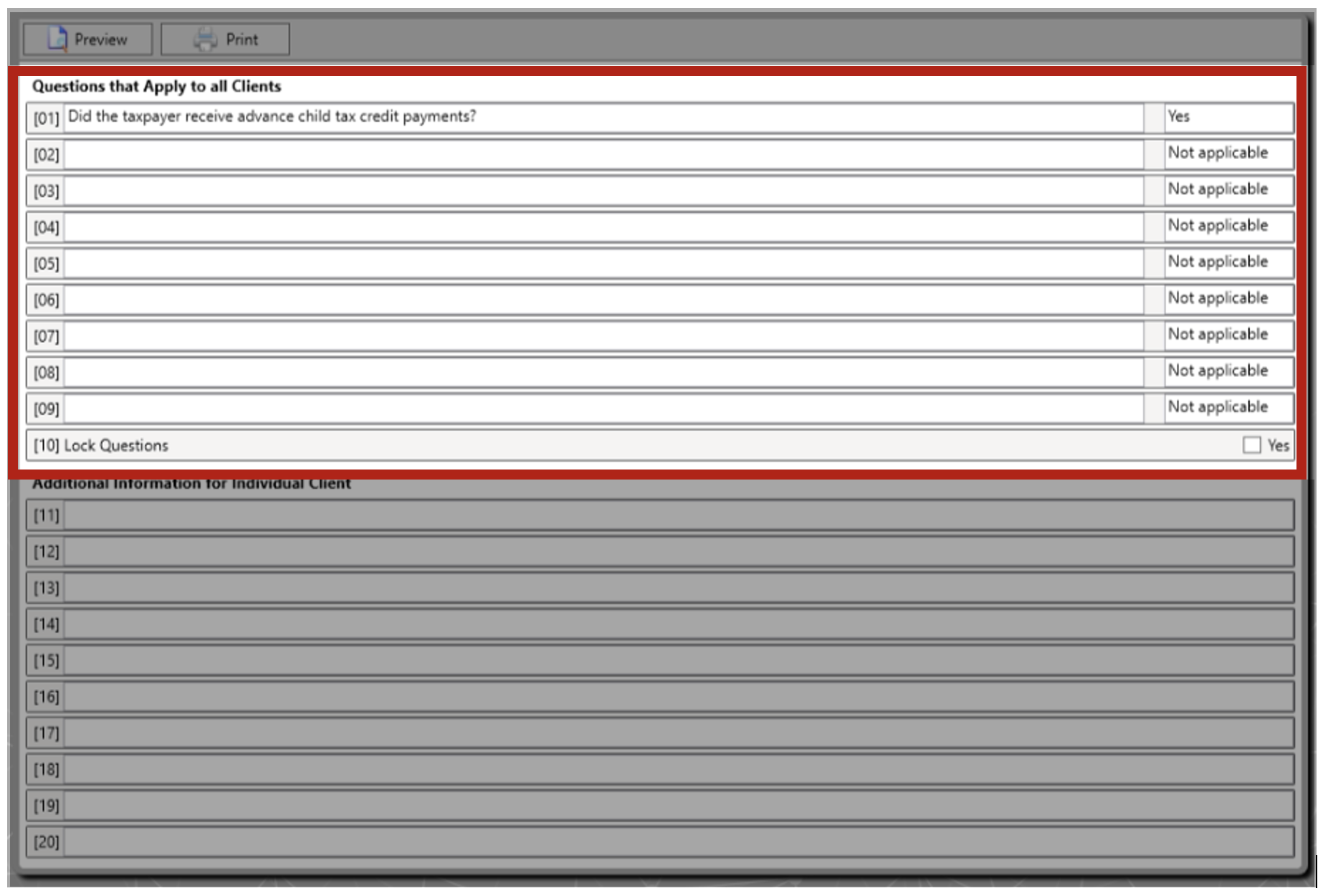

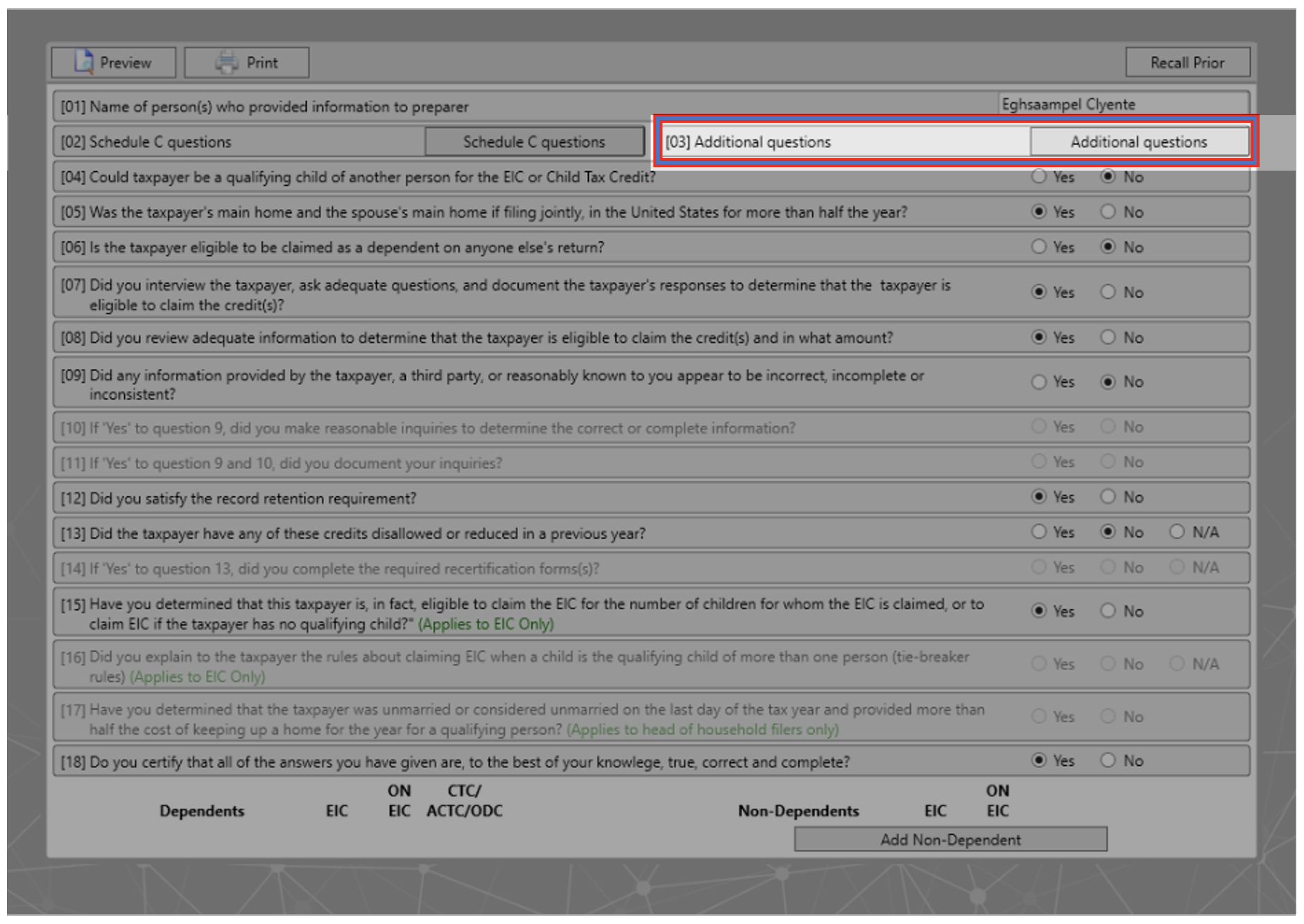

Advance Child Tax Credits that were part of 2021 tax returns contain details that can easily be noted in the Wintax Due Diligence feature. Why not maximize our Due Diligence option to be sure you are maintaining information most important for your records? This feature not only allows you to craft your own sets of questions, but also saves any data you input about your clients for use in next year’s returns. You can store up to 9 additional “yes/no” Due Diligence questions. Plus, there is space for more notes! These questions and answers are not transmitted to the IRS during E-File. They are for your reference in case of an audit or other line of inquiry.

DUE DILIGENCE SCREEN

ADDITIONAL QUESTIONS SCREEN