A Comprehensive Look at EFINs and PTINs

Electronic Filing Identification Numbers (EFINs):

An EFIN is a six digit number assigned by the IRS for identifying tax firms.

Anyone filing more than 10 returns in a tax year must do so electronically through their firm’s EFIN.

How to acquire an EFIN:

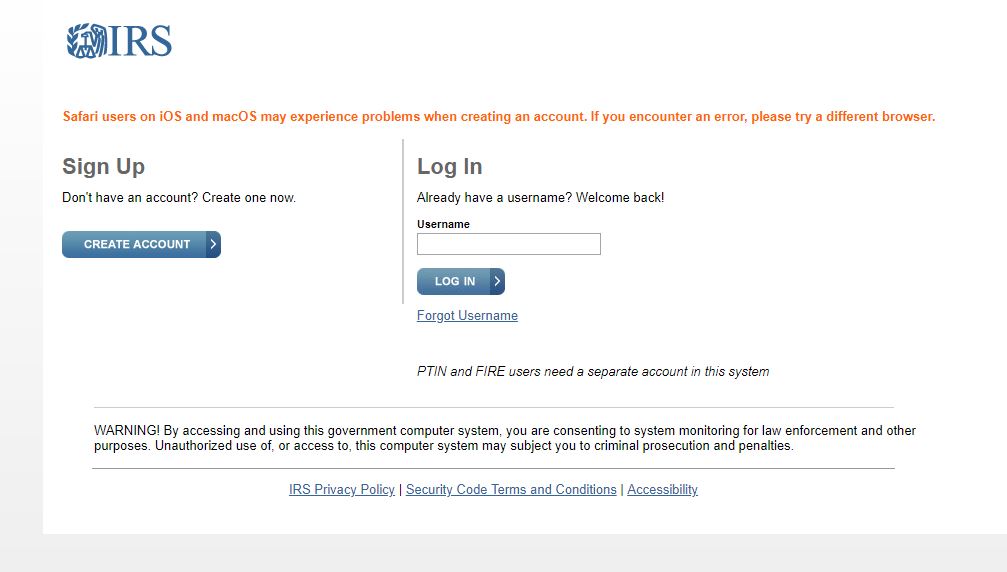

Step 1- Follow this link

Step 2- Select “Create Account” and fill out the information to create your e-Services account.

Step 3- Fill out an application to become an Authorized e-file Provider from your e-Services account.

Step 4- You will be asked to complete a suitability check. The suitability check may include a fingerprint, credit check, criminal background check, a tax compliance check and a check for previous non-compliance with IRS e-file requirements.

This process may take up to 45 days, so we suggest applying for an EFIN as soon as possible to make sure you are ready for the next tax year.

Professional Preparer Tax Identification Numbers (PTINs):

The PTIN is a nine-digit number that is used to identify a paid tax preparer of any federal tax return or claim of refund.

Anyone who prepares or assists in preparing federal tax returns for compensation must have a valid PTIN.

PTINs expire at the end of every year and must be renewed annually in order to prepare taxes.

How to register for or renew a PTIN:

Step 1: Access your e-Services account

Step 2: Verify your personal information and answer the questions provided.

Step 3: Confirm PTIN renewal

If you do not have a PTIN and need to obtain one, you can go here to get started.