Basic 8915-F Instructions for 2021

Basic 8915-F Instructions for reporting 1/3 of the 2020 Gross Distribution in 2021.

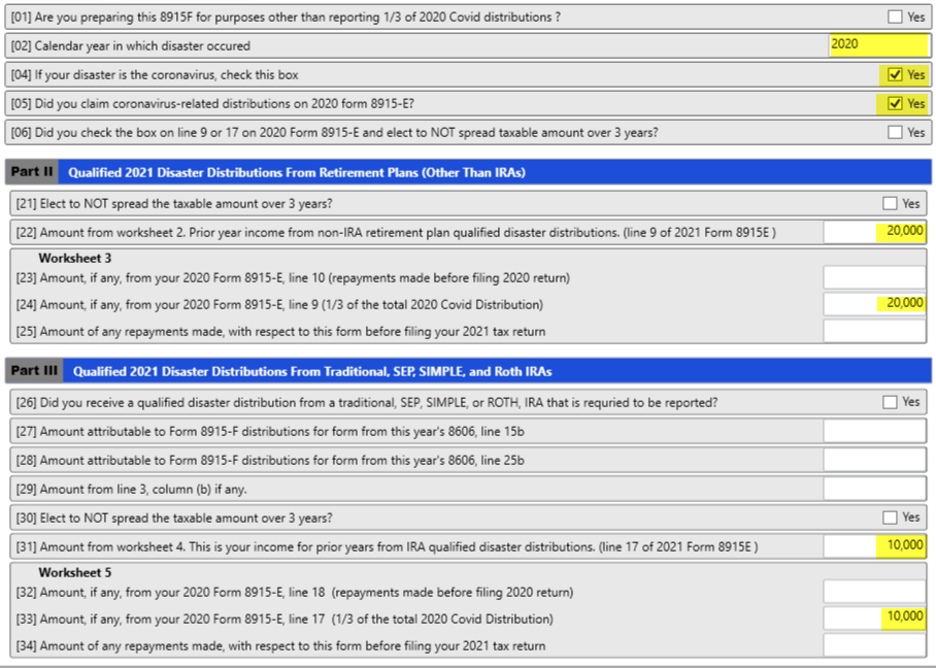

Typical scenario:

In 2020 the Taxpayer took a distribution of 60,000 from a Non IRA retirement account and he also took a 30,000 distribution from an IRA. For 2020 form 8915-E was filed and 1/3 of these distributions were included in the 2020 tax return.

For 2021 8915-F will be filed and menu below will show how the numbers should be entered.

Line 1: The year will be 2020.

Line 2 and 3 will be checked Yes.

For the 60,000 Non IRA total distribution made in 2020, Lines 22 and 24 should show 20,000 (1/3 of the total distribution)

If the Taxpayer made any repayments and put some of the money back into the Retirement account, then you would enter the amount repaid on line 25. The net will then carry to the 1040.

For the 30,000 IRA total distribution made in 2020, Lines 31 and 33 should show 10,000 (1/3 of the total distribution).

Line 34 is for any repayments that were made after filing 2020 taxes and before filing the 2021 return.